Shares audience insights and a new way to look at those aged 50+ in the US, helping marketers develop offerings that resonate with the aspirations of older consumers.

The 50+ demographic – projected to comprise over 50% of the adult population by 2050 – holds a disproportionate share of America’s wealth, at 70%, but remains underserved by brands.

Even though this group is the most valuable demographic ever, most brands continue to overlook this opportunity and only direct 5%–10% of marketing spend towards it.

At least in the US, the more affluent of the 50+ demographic have adopted distinct lifestyles not evident in prior generations.

Why it matters

Those in the 50+ demographic are dominant purchasers of higher-value products such as cars, travel, healthcare, home goods, financial services, fashion and entertainment. Surprisingly, for those who believe that targeting younger audiences will lead older audiences to follow along, in higher-value categories, it can be the other way around. The combination of purchasing power, influence over younger audiences, and a strong sense of what’s important makes the 50+ age cohort incredibly valuable to brands seeking growth.

Takeaways

The prevalence of generational thinking (“Boomers,” “Millennials,” “Gen Z,” etc.) hinders brands from effectively engaging the lucrative and influential 50+ segment, because it reinforces age biases and negative stereotypes. Additionally, marketers’ long-term over-emphasis on the 18–34 age group has created a knowledge gap about the needs, motivations, and spending patterns of older consumers.

The 50+ demographic is more dynamic, diverse and wealthier than stereotypes suggest; according to new research, their nuanced needs and desires fall into six distinct segments that are defined by what matters to them and what they are willing to pay for.

Because this age demographic has long-term, emotional connections to brands and is willing to pay for intangible equities such as virtues and values, marketers need to think beyond short-term metrics and immediate sales impact when evaluating marketing to the 50+ audience.

The new demographic reality: It’s no longer profitable for businesses to focus on youth

Since the beginning of the baby boom following World War II (1946–1964), America’s population has been boosted by millions of young people born each year and waves of immigrants migrating to America. Many of the world’s most successful brands made their name by winning over these new, young customers with youth-focused marketing campaigns. In 1960, America was a youth-dominated market, with most of the population

(57%) under 35 and only 23% over 50. The sheer scale and influence of the group called “Baby Boomers” allowed the brands that served them to transform and grow in almost every business sector.

Over time, brands got into the habit of targeting young people and assuming older customers would follow. After the “Boomers” came “Generation X,”… “Millennials,”… “Gen Z,” … and now “Gen Alpha,”… with almost every sector looking to target the next youthful wave, so much so that the AARP (American Association of Retired Persons) has estimated that only 5–10% of marketing spending is directed towards those aged 50+, and the majority of media buying and creative strategies feature and focus on the needs of the 18–34 audience.

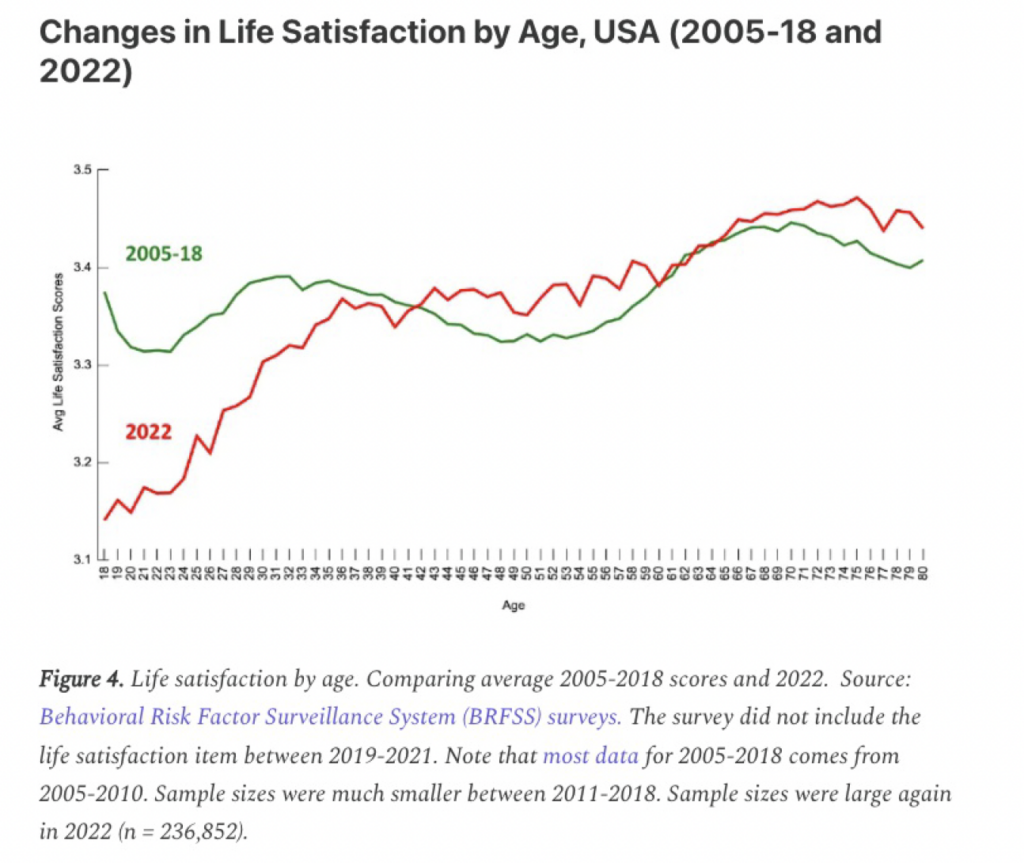

But, while the 50+ cohort has been gaining economic power, the financial prospects for 18- to 34-year-olds have been declining, causing historic levels of anxiety and despair. In the US, young people leave college with more educational debt than previous generations; high rents and low salary growth make it almost impossible for them to accrue savings; they are becoming financially dependent on their parents; and the cost of borrowing makes it impossible to buy a house. What’s more, this reality, the impact of climate change, and the emergence of artificial intelligence as a threat to their careers are causing a reversal in the notion that the young are happy, carefree, and aspirational. These trends have resulted in a dramatic decline in life satisfaction for younger adults, as evidenced by the US statistics below.